With reimbursement accounting for as much as 75% of hospital revenues, denied claims can be very costly. That’s why a strong denials management process is important for healthcare providers. A recent survey found that denials management is the most time-consuming revenue cycle task. Fortunately, there are ways to improve your denials management processes, saving time and capturing more reimbursement.

Short on time? Watch the iPro Byte version of this blog post.

Ensure Data is Accurate and Easily Shared

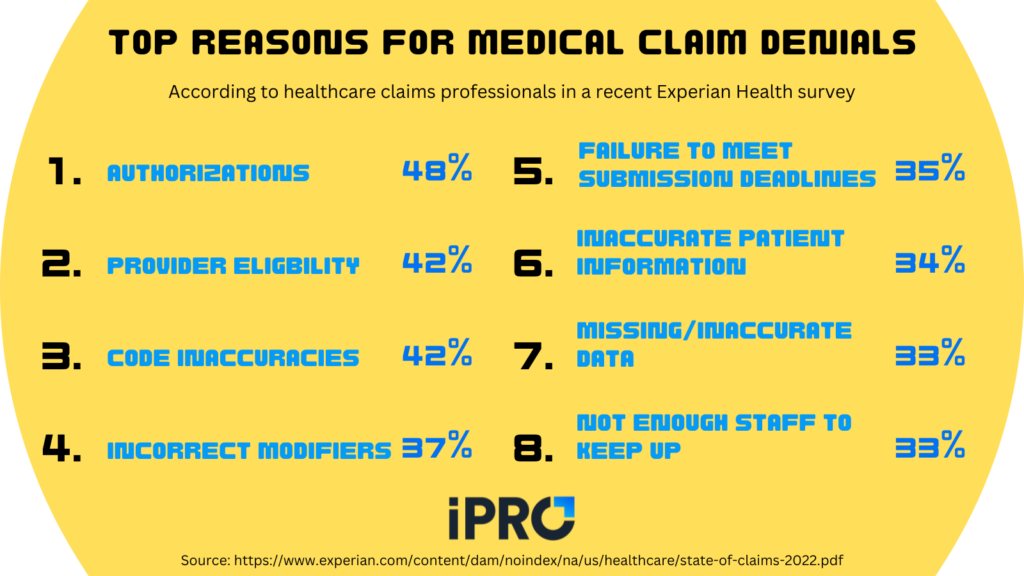

Ensuring data accuracy is critical to preventing claim denials. According to a recent Experian Health survey, half of the top 8 reasons for claim denials involved accuracy:

- Code inaccuracies (42%, T-reason #2)

- Incorrect modifiers (37%, reason #4)

- Incorrect patient information (34%, reason #6)

- Missing/inaccurate data (33%, T-reason #7)

Inaccurate information on claims can lead to denials and delayed care, requiring the claims to be reworked and resubmitted. This is costly for healthcare providers and can have serious adverse health effects for patients. Ensuring accuracy and preventing rework keeps both patients and providers happy.

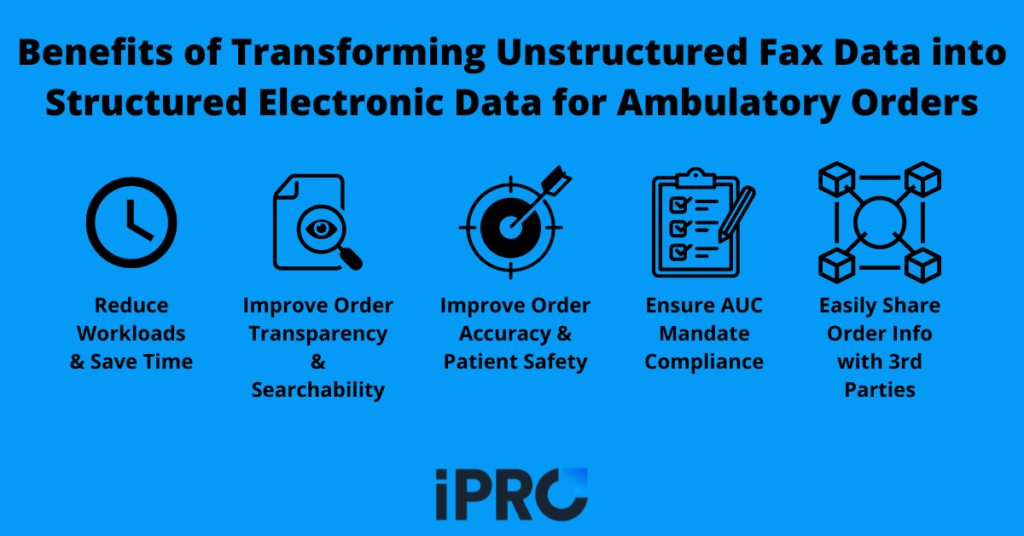

Data accuracy is only one part of the equation, however. Data also needs to be easily shared to ensure timely decisions are made. For data to be easily shared, or interoperable, it needs to be in a structured format. Unstructured data, like text on a faxed order, isn’t searchable. This requires manual entry which is time-consuming and can lead to errors and delays. Some analysts estimate 80-90% of data is unstructured, making it a major pain point for healthcare providers.

A great solution to ensure both data accuracy and interoperability is an order management solution that offers complete order validation and transparency. Our iOrder software with integrated clinical decision support does just that by generating an electronic order that is interoperable and validated for accuracy. iOrder prevents ICD-10/CPT code mismatches, eliminating errors and ensuring the right order for the right patient. It also has the capability of converting unstructured fax data into structured electronic data, ensuring data is easily shared. All of this helps reduce claim denials, speed up turnaround time, and increase reimbursement.

Utilize Automation to Streamline Workflows

Another way to improve your denials management process is to automate routine tasks to streamline workflows. This saves time, improves efficiency, reduces errors, and can either reduce labor costs or free up staff to focus on other tasks. In fact, the lack of automation in the claims/denials process was one of the top 3 reasons for increased denials according to respondents in the previously mentioned Experian Health survey.

In response to this, 52% of respondents upgraded or replaced previous claims process technology in the past year. Other ways providers utilized automation to reduce claim denials include:

- Automated tracking of payer policy changes (45%)

- Automated or expanded patient portal claims reviews (44%)

- Digitized the registration process (39%)

Automating aspects of your patient engagement initiatives is also a great way to reduce the administrative burden from staff. SMS appointment reminders, links to procedure-specific instruction videos, and facility navigation assistance are just a few examples of automating patient engagement. In addition to freeing up staff or saving money on labor costs, automating your patient engagement initiatives can improve the patient experience. Improving patient engagement can yield increased and faster payments and reduce costs to collect.

When it comes to who develops and maintains the automation technology, the breakdown was as follows:

- 49% develop in-house solutions

- 43% leverage the expertise of 3rd-party consultants/vendors

- 51% use robotic process automation (RPA)

- 11% use AI

If you’re considering utilizing automation to streamline your claim processes, check out these 7 common traits of top healthcare IT vendors.

Create an Exception-Based Special Team

While many claims can be handled with automation, there will still be exceptions. With automation reducing administrative tasks, patient financial services staff can focus on claims that require special attention. Whether an exception requires additional documentation or it needs to be reworked (because automation will never be perfect), having a dedicated, knowledgeable team can help keep your claim denials management process running smoothly. If staffing is still an issue, consider outsourcing these tasks to a third-party specialist.

Partner with a Vendor that Customizes Solutions for Your Needs

When it comes to improving your denials management processes, technology plays a big role. With 43% of providers turning to vendors for their tech needs, it’s important to partner with vendors who are experienced and flexible. At iPro, we customize solutions to fit our clients’ needs. Whether it’s integrating with EHR’s and other applications or adding new features based on customer feedback, we’re here to help you succeed. We partner with our clients every step of the way, from identifying their goals to 24/7 support post implementation.

Our ambulatory order management solution, iOrder, helps improve your denials management processes by generating an electronic patient order with complete validation and transparency. This eliminates errors and reduces claim denials and resubmissions. An integrated clinical decision support mechanism (qCDSM) further ensures accuracy and proper documentation. We also offer third party prior authorization assurance services to relieve your staff of this time-consuming burden and streamline the prior authorizations process. Our automated patient engagement tools help reduce no-shows and rescheduling through SMS-based appointment reminders, links to procedure-specific instruction videos, and GPS navigation assistance.

All-in-all, iOrder helps healthcare providers generate positive ROI in as little as 2 months, and as much as 2-5x their investment in the 1st year, by reducing claim denials and labor costs and increasing reimbursement. This two-prong approach of reducing costs and increasing revenue can help providers overcome financial challenges in a short amount of time. To learn more about iOrder’s financial impact, watch the video below or schedule a free live demo today.