Healthcare revenues are rebounding as the COVID-19 pandemic subsides, but there’s always room for improvement. With reimbursement accounting for as much as 75% of hospital revenues, maximizing reimbursement is a great way to grow revenue for healthcare providers. However, there are several challenges that can affect reimbursement, such as:

- Claim denials

- Coding issues

- Prior authorizations

A recent report by Syntellis shows that even a small reduction in a hospital’s bad debt and charity deductions (which includes claim denials) can result in roughly $1.5 million in savings for hospitals with 100-199 beds, and as much as $5.3 million in savings for 300-499 bed hospitals. With that in mind, let’s look at how hospitals can overcome the three reimbursement challenges and grow revenue.

Healthcare Reimbursement Challenge 1: Claim Denials

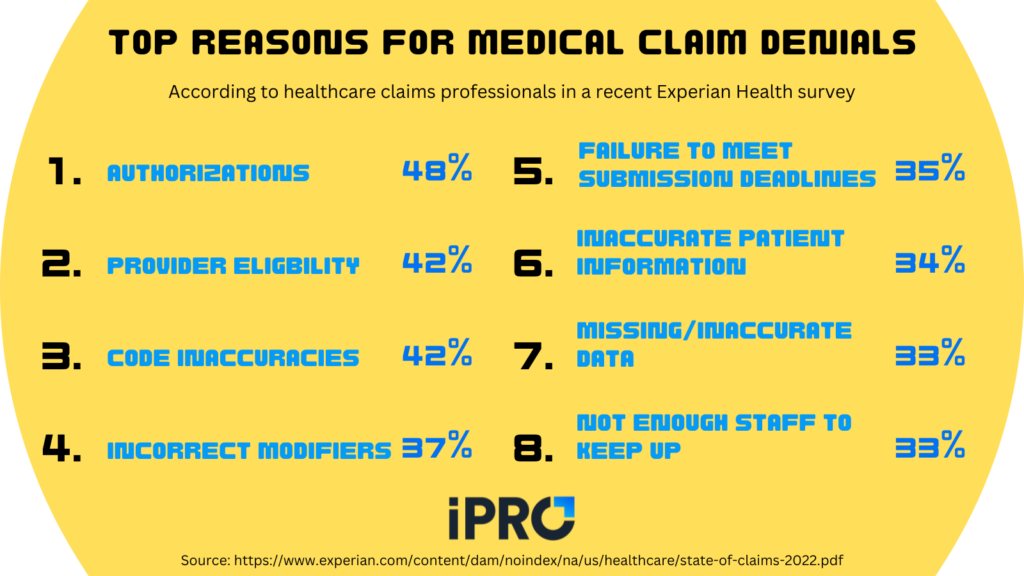

One of the top healthcare reimbursement challenges is claim denials. According to two recent surveys of healthcare financial leaders, denials management requires the most subject-matter expertise (79%) and is the most time-consuming revenue cycle task (76%). Claim denials are frustrating for both patients and providers as they result in delayed care for the patient and revenue leakage for providers. Adding to the burden is the fact that claims may be denied for many reasons. According to respondents in a recent Experian Health survey, top reasons for claim denials include:

- Authorizations (48%)

- Provider Eligibility (42%)

- Code inaccuracies (42%)

- Incorrect modifiers (37%)

- Failure to meet submission deadlines (35%)

- Patient information inaccuracy (34%)

- Missing or inaccurate claim data (33%)

- Not enough staff to keep up (33%)

A common theme among reasons for denied claims is inaccuracy, whether it be coding errors, patient data inaccuracy, or other forms of inaccurate data. The right technology can help reduce denied claims by ensuring accuracy and reducing or eliminating human error. In fact, 74% of respondents in the Experian survey expect to

“probably” or “definitely” invest in more claims processing and/or denial reduction technology. The prospect of improving ROI makes denial reduction technology even more inticing:

78% of respondents said they would be “extremely” or “somewhat” likely to replace existing technologies if presented with compelling ROI

https://www.experian.com/content/dam/noindex/na/us/healthcare/state-of-claims-2022.pdf

When considering denials reduction technology, be sure to ask potential vendors for a projected ROI schedule to get an idea of how soon the investment will pay off.

Healthcare Reimbursement Challenge 2: Coding Issues

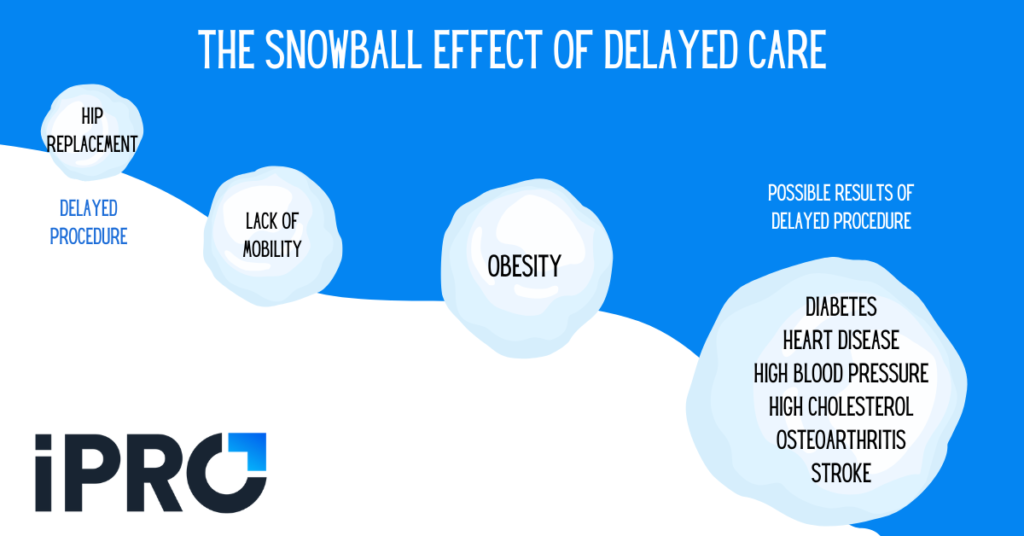

As we saw in the previous section, coding inaccuracies are a frequent reason for denied claims. In fact, they are tied with provider eligibility for the number 2 spot in Experian’s survey (42%). Human error in the ordering and/or billing process can lead to ICD-10/CPT code mismatches. When this happens, a claim may be outright denied or sent back for correction and resubmission. In either instance, patient care is being delayed, which can lead to a snowball effect of adverse events for the patient.

For providers, this can lead to delayed or denied reimbursement. Another form of revenue leakage from coding errors and denied claims is patients shopping around for care. With healthcare disruptors on the rise, patients have more options than ever. Errors made by healthcare staff resulting in delayed care or frustration for patients can harm the patient-physician relationship and lead to revenue leakage.

A great way to combat coding errors is to utilize tech that validates patient orders for accuracy and flags errors before they’re submitted. Our ambulatory order management solution, iOrder, does just that. Watch this video to learn more about how iOrder and its integrated clinical decision support mechanism checks for medical necessity, eliminates coding errors, and can grow revenue by 3-5%.

Healthcare Reimbursement Challenge 3: Prior Authorizations

According to Experian Health’s survey, prior authorizations are the top reason for claim denials, with 48% of respondents indicating so. It’s also the 2nd most time-consuming revenue cycle task according to a recent Akasa survey, behind only denials management. This makes prior authorizations one of the biggest healthcare reimbursement challenges. Much like issues with coding, prior authorizations issues can lead to delayed or abandoned care for patients and revenue leakage for providers.

Streamlining the prior authorizations process can help reduce claim denials and maximize reimbursement. Removing the burden of prior authorizations from staff can also:

- Reduce staffing needs

- Free up staff to focus on other tasks

- Increase time physicians can spend with patients

- Reduce burnout and stress among staff

A great way to overcome prior authorizations challenges is to outsource your prior authorizations process to a third-party. Prior authorization assurance services, like iOrder’s integration with AuthNet, handle all the heavy lifting so your staff doesn’t have too. This results in faster prior authorizations turnaround, fewer denials, and faster reimbursement. Watch the video below for more info on how iOrder can help with your prior authorizations needs.

Growing Revenue Doesn’t Have to Take Forever

As many hospitals are operating on thin ice when it comes to revenue, it’s important to grow revenue wherever possible. Check out these 6 tips for recovering healthcare revenue losses and stopping leakage.

As we’ve discussed, maximizing reimbursement is a great way to grow revenue. To recap, three ways of overcoming reimbursement challenges are:

- Reducing claim denials

- Improving coding accuracy, and

- Streamlining prior authorizations

Implementing the right technology to overcome these challenges may seem like a time-consuming endeavor and have you wondering when you’ll actually realize the revenue benefits. At iPro Healthcare, we know time is money. That’s why we’re proud to offer a solution that can reduce claim denials, improve coding accuracy, and streamline prior authorizations to generate a positive ROI in as little as 2 months. Our ambulatory order management solution, iOrder, cleans up your ordering process, leading to reduced claim denials, maximized reimbursement, a greater patient experience, and more referrals. To learn more about how iOrder can pay for itself and grow your revenue in only a few months, schedule a free live demo today.